If you’ve ever tried to scale a small business in India, you know the “collateral wall” all too well. For years, the struggle to provide physical assets—like property or gold—as security has kept countless brilliant entrepreneurs from accessing the capital they need.

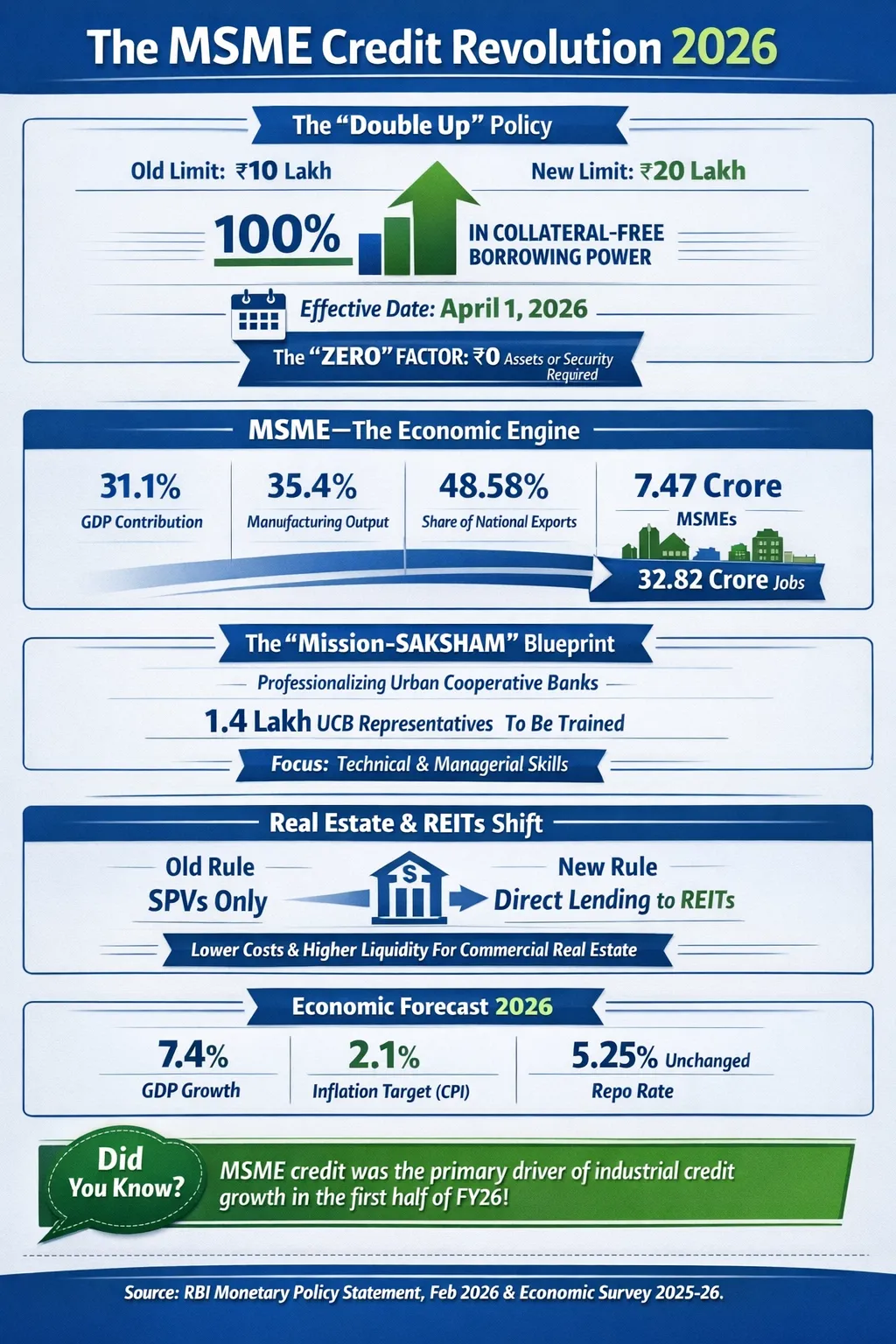

On February 6, 2026, the Reserve Bank of India (RBI) dismantled part of that wall. RBI Governor Sanjay Malhotra announced a landmark policy shift, doubling the limit for a collateral-free msme loan from ₹10 lakh to ₹20 lakh. This 100% increase isn’t just a number on a spreadsheet; it’s a massive vote of confidence in the 7.47 crore MSME firms that drive our economy.

Why the MSME Loan Limit Increased Now

The timing of this announcement is critical. The MSME sector currently powers 31.1% of India’s GDP and nearly 48.58% of our national exports. Despite this, “credit hunger” remains the biggest hurdle for growth.

Essentially, the RBI is acknowledging that for a micro-enterprise to survive in 2026, ₹10 lakh simply doesn’t buy what it used to. By raising the msme loan threshold, the central bank is adjusting for inflation and ensuring that first-generation entrepreneurs can secure working capital without the fear of risking their personal assets.

Key Highlights of the RBI Policy Shift

The recent MPC meeting wasn’t just about MSMEs. It introduced a suite of reforms designed to professionalize banking and increase liquidity in the market.

1. Doubling Down on MSME Credit

The primary takeaway is the doubling of the msme loan limit.

- New Limit: ₹20 lakh (up from ₹10 lakh).

- Effective Date: Applicable for loans sanctioned or renewed from April 1, 2026.

- No Security Needed: Applicants can secure these funds without providing any physical assets or third-party guarantees.

2. Boosting Real Estate through REITs

In a significant move for the property market, banks are now authorized to provide loans to Real Estate Investment Trusts (REITs). Previously, banks could lend to Infrastructure Investment Trusts (InvITs), but REITs were left out. This change is expected to inject much-needed liquidity into commercial real estate, provided banks follow the new prudential safeguards.

3. Mission-SAKSHAM and Cooperative Banking

To ensure our local banks are as sturdy as our national ones, the RBI launched “Mission-SAKSHAM” (Sahakari Bank Kshamta Nirman). This initiative aims to:

- Train over 1.4 lakh representatives from Urban Cooperative Banks (UCBs) in technical and managerial skills.

- Rationalize rules for unsecured lending while removing housing loan restrictions for Tier III and Tier IV UCBs.

How This Impacts Your Business

You might find that this policy shift changes your financial strategy for the upcoming fiscal year. Here is how the msme loan limit increased benefits the average business owner:

| Feature | Old Policy | New Policy (April 2026) |

| Collateral-Free Limit | ₹10 Lakh | ₹20 Lakh |

| Asset Requirement | Required above ₹10L | No assets needed up to ₹20L |

| Target Audience | Micro & Small Enterprises | Micro & Small Enterprises |

| Focus | Survival/Maintenance | Scaling & Digital Adoption |

Furthermore, the RBI is encouraging lenders to move away from “asset-backed lending” and toward cash-flow-based assessments. This means banks will look at your GST data and digital transactions rather than your property papers.

Strengthening the Ecosystem

While the headline is the msme loan, the RBI is also tightening the ship elsewhere. New restrictions on unsecured lending by Urban Cooperative Banks aim to prevent “over-leveraging,” ensuring that while credit is easier to get, the system remains stable.

The introduction of a Unified Reporting Portal for the Lead Bank Scheme will also make it easier for the government to track where the money is going, ensuring it reaches the “last mile” of the Indian economy.

Final Thoughts: The RBI’s decision to double the collateral-free msme loan limit is a pragmatic response to the evolving needs of Indian industry. By removing the requirement for security up to ₹20 lakh, the central bank is effectively handing a “growth kit” to millions of small business owners. Whether you are looking to upgrade machinery, expand your team, or stabilize your cash flow, the path to formal credit just got significantly smoother.